HMRC furlough portal for employers now live

Date published: 20 April 2020

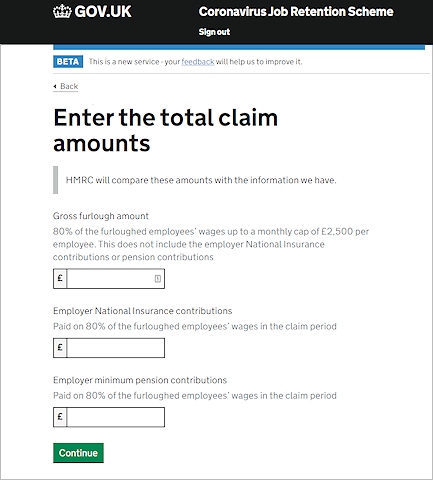

HM Revenue & Customs furlough portal

The HM Revenue & Customs portal allowing employers to claim for 80% of furloughed employee’s wages plus any employer National Insurance and pension contributions, has gone live today (20 April).

Although the system is supposed to be able to handle up to 450,000 applications an hour, a huge demand is expected to be placed on the system.

In order to claim the cash grant from HMRC, employers simply need to use the new online application service. Employers should then receive the money to pay their employees within six working days.

In order to complete a claim, you will need:

- your employer PAYE reference number

- the number of employees being furloughed

- National Insurance Numbers for the employees you want to furlough

- Names of the employees you want to furlough

- Payroll/works number for the employees you want to furlough

- your Self Assessment Unique Taxpayer Reference or Corporation Tax Unique Taxpayer Reference or Company Registration Number

- the claim period (start and end date)

- amount claimed (per the minimum length of furloughing of 3 consecutive weeks)

- your bank account number and sort code

- your contact name

- your phone number

You will need to calculate the amount you are claiming. HMRC will retain the right to retrospectively audit all aspects of your claim.

More details can be found here:

To be eligible for the scheme, employers must have:

- created or started a PAYE payroll scheme on or before 19 March 2020

- enrolled for PAYE Online

- a UK bank account

Employers can claim for furloughed employees who were both:

- on their PAYE payroll on or before 19 March

- included in a 'Real Time Information' (RTI) submission to HMRC on or before 19 March

Claims can be made for any type of full-time or part-time employee. This includes:

- employees

- workers and agency workers

- those on zero hours contracts

- apprentices

Employers need to:

- select and tell ('designate') the employees affected that they're furloughed

- get written agreement (and keep it for 5 years)

- keep employees on the employer's payroll and continue their employment contracts

- make sure furloughs last at least 3 weeks

Make a claim:

Further information can be found at:

Do you have a story for us?

Let us know by emailing news@rochdaleonline.co.uk

All contact will be treated in confidence.

Most Viewed News Stories

- 1Former councillor and hospital campaigner Jean Ashworth has died

- 2Middleton school hails another outstanding inspection result

- 3Northern Healthcare opens supported living service in former Rochdale hotel

- 4Family event to celebrate Earth Day to be held at Number One Riverside

- 5No trams between Oldham and Rochdale this Sunday

To contact the Rochdale Online news desk, email news@rochdaleonline.co.uk or visit our news submission page.

To get the latest news on your desktop or mobile, follow Rochdale Online on Twitter and Facebook.